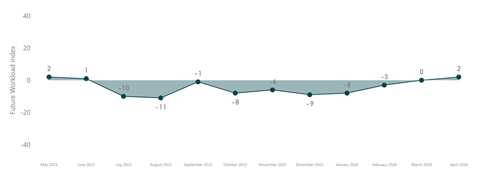

Architects finally expecting workloads to increase after longest ever run of pessimism in RIBA’s Future Trends survey

Architects expect workloads to increase for the first time in ten months as market demand strengthens, according to RIBA’s latest Future Trends survey.

The institute’s sentiment survey for April showed confidence returning to the profession with a balance of architects now expecting work to rise over the next three months.

The survey’s index score rose to plus +2 last month, up from zero in March and -3 in February. Any score above zero indicates that practices on average expect workloads to increase.

Over the next three months, 19% of practices expect workloads to increase, 17% expect them to decrease, and 63% expect them to stay the same.

The index has been rising since January but April’s score is the first time it has been in positive territory since June last year, the longest unbroken run of pessimism since the survey began in 2009.

The results come following the latest official inflation figures showing price rises have slowed 2.3%, their lowest rate in almost three years, while the International Monetary Fund has upgraded its forecast for UK GDP growth in 2024 from 0.5% to 0.7%.

RIBA head of economic research and analysis Adrian Malleson said April’s survey findings were “the most encouraging for some time, and part of a longer-term trend of an improving outlook, despite month-on-month fluctuations.”

He added: “Some practices also note a strengthening market overall, an uptick in the public housing sector, and the significance of overseas work.”

But he also cautioned that workloads are lower than they were a year ago and there were still high levels of personal underemployment.

The survey’s staffing index, the amount of permanent staff practices expect to employ over the next three months, fell by two points to zero, with one in ten firms now expecting to cut headcount.

Practices also reported that cash-flow problems, planning delays, raised interest rates, and increased project costs continue to hold back project progress, new enquiries, and new commissions.

1 Readers' comment