Overall revenue and profit “hold steady” despite limited growth, but pay gaps widen at big firms

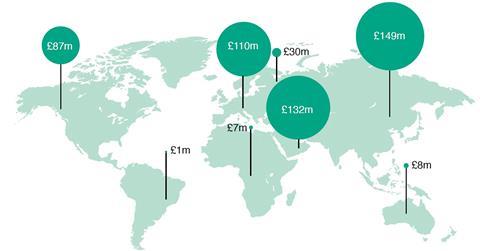

Architects have reported a further decline in revenue from international work in the latest RIBA Business Benchmarking survey, with last year’s 14% fall compounded by an additional 2% drop.

Because data for the annual reports covers RIBA chartered practices’ experiences in the 12 months to May each year, its 2021 and 2022 Business Benchmarking results are a snapshot covering the first whole-year periods since the UK’s formal departure from the European Union.

According to the figures, revenue from international work was £524m last year, down from £535m in 2021, and £624m in 2020. Survey respondents reported international-work revenue of £625m in 2019, meaning the latest figures are the third consecutive year of contraction. However 2019 saw practices’ international revene surge 22% on the previous year.

RIBA said the 2022 survey results showed evidence of increased income being generated from international work on the part of the largest UK practices – those with 100 staff or more. It said that showed “emerging” potential for improvements in the situation next year and beyond.

The survey found Asia overtaking the Middle East as UK practices’ most significant source of international work.

The timeframe for the survey means it does not reflect inflationary pressures felt by design firms over the summer, including the economic fallout from Russia’s invasion of Ukraine.

Adrian Malleson, RIBA’s head of economic research and analysis, said the over-arching message from the survey data was of a profession “holding steady” in the wake of the coronavirus pandemic.

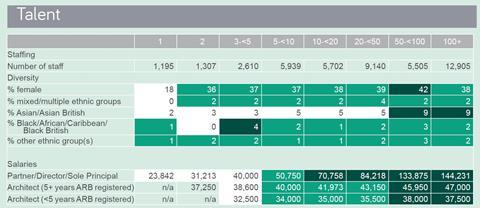

Malleson said overall revenue was up by 1% to £3.1bn while profit was at a similar level to 2021 and staff numbers at practices were up 17% – essentially back to pre-pandemic levels.

“This year’s findings show some signs of recovery and stability – demonstrating the resilience of UK practices, and their ability to rapidly adjust to unprecedented changes. But it’s no boom time,” he said.

“The market continues to grapple with numerous challenges ranging from materials shortages and price increases to a scarcity of tradespeople and labourers, and a smaller pool of architectural talent post-Brexit.”

Malleson conceded that the coming 12 months are likely to present more challenges to the architecture sector and urged the government to do some pump-priming.

“With a two-year-long recession forecast, growth is unlikely to return to the UK economy until late 2024 or early 2025. We can expect the construction sector to feel the impacts of this,” he said.

“With public spending set to be cut, RIBA continues to promote the importance of a sustainable design-led renewal of the built environment. Better houses, schools, hospitals alongside rejuvenated town and city centres are required.

“Investing in the built environment will increase economic productivity, benefit our communities, and help secure the county’s long-term success.”

Elsewhere in the Business Benchmarking 2022 survey, RIBA reported that equality, diversity and inclusion progress appeared to have stalled, with gender and ethnicity pay gaps widening.

RIBA said more than 50% of practices still did not have EDI staff training in place. It added that the gender pay gap had widened from 15% to 17% since 2021, while the ethnicity pay gap had grown from 14% to 22%, based on data voluntarily submitted by practices with 100 or more staff.

For the first time, the Business Benchmarking report included figures on the notoriously escalating cost of professional indemnity insurance.

It found the all-practice average for cover was £2m, rising to £10m for larger practices – with 20 or more staff.

RIBA chartered practices reported an average PII premium of £32,926, up from £16,874 in 2018.

Malleson said that while the figures equated to a 95% increase in five years, the rise had slowed to 3% in 2021-2022.

“Led by our board and a dedicated group of expert RIBA Council members, we are working with the wider construction sector and insurance industry experts as we seek to secure sustainable premium levels and comprehensive cover for architects’ services,” he said. “We hope to share an update on this work with our members in early 2023.”

No comments yet