Future Trends update flags recruitment chill in London, Wales and the west, and the south

The RIBA’s latest survey of industry sentiment has registered a dip in workload confidence among practices in London, the south, Wales and the west of England while housing remains the only industry sector where confidence in the future remains strong.

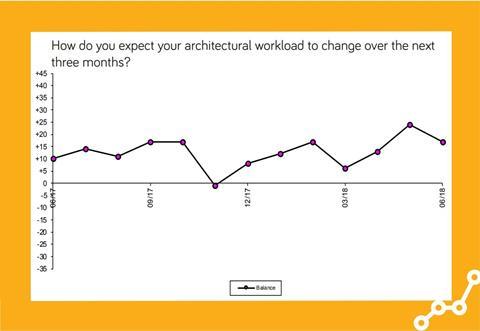

Revealing the findings of its June Future Trends business barometer of around 180 practices, the institute said that while practices on the whole were maintaining a positive outlook on their future workloads, it was weaker than in May – reflected in the survey’s Workload Index reducing from +24 to +17.

Broken down by region, the north, the Midlands and East Anglia were the most upbeat in terms of their assessment of their medium-term workloads. London practices continued with their recent cautious trend, however Wales and the west of England and the south saw significant drops in confidence levels.

London’s workload confidence dropped from +16 in May to +12, but confidence in Wales and the west plummeted from +28 to +6 and the south dropped from +24 to +4.

Comparing construction sectors, housing was the only one with a double-figure positivity rating, scoring +22. RIBA said all other sector workloads were down between May and June, with the public sector forecast was down to -4, indicating an expected overall decline in work.

In terms of staffing, firms’ overall positivity on numbers growth dropped from +12 to +2 from May to June, but the figures appeared to mask a reasonable degree of confidence among larger firms contrasting with no expectation of growth among practices with 11-50 employees.

Regionally, practices in London were not expecting growth in numbers while those in the south, Wales and the west of England gave negative confidence ratings.

RIBA executive director for members Adrian Dobson said the commentary from practices that took part in the survey continued to suggest a “reasonably steady work flow”, but he added that firms were also reporting a highly competitive market in terms of achievable fee levels.

“A small number of correspondents report that they have seen significant construction tender price inflation and that this has led to delays in getting projects to site,” he said.

Dobson also cautioned against practices placing too much reliance on housing as a source of stability for the architecture and design sectors, pointing to a number of factors that could dent its performance.

“The private housing sector remains the driving force sustaining a stable market for architectural services,” he said. “But despite the fact it looks positive on the whole, a cooling of the housing market in London and the south of England, increases in interest rates and potential withdrawal of right to buy subsidies may impact on this sector in the medium term.”

1 Readers' comment