RIBA survey finds some practices reporting “early signs” of an improving market and more overseas opportunities

RIBA’s latest barometer of business sentiment in the architecture sector has found an increase in optimism compared with the previous month – but workloads and staffing levels are still expected to fall in the coming quarter.

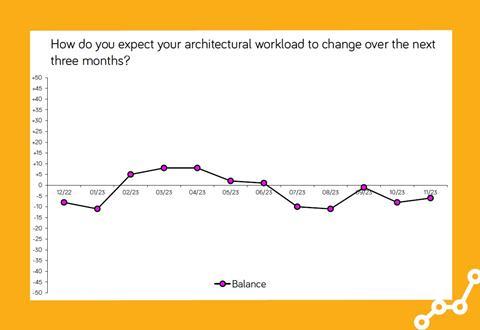

The institute’s Future Trends survey responses for November found 21% of practices expect workloads to increase over the coming three months, while 51% expect them to stay the same and 28% expect them to decrease.

Responses are used to produce the Workload Index, which now stands at -6 in an indication of negative expectations. However the figure is an improvement on October’s -8.

A breakdown of all 270 responses to the survey shows a marked divergence in optimism between firms with 10 or fewer staff and bigger businesses .

Month-on-month pessimism about future workloads increased among smaller practices, whose combined Workload Index score dropped three points to -12.

Medium-sized and large firms were firmly in positive territory with a combined Workload Index score of +24, a 22-point increase on October’s figure.

The Future Trends Permanent Staffing Index rose by one point to -3, indicating that practices expect to employ fewer staff over the coming three months.

Five percent of firms expect to employ more permanent staff, 9% expect to employ fewer staff, and 86% expect no change. Expectation of reduced staffing levels was most acute among smaller practices.

Regionally, Wales and the West was the only area that expected staffing to rise across the board.

RIBA head of economic research and analysis Adrian Malleson said the latest Future Trends results, which were published on Thursday, showed a profession still pessimistic about future workloads – but also suggested that the outlook had stabilised.

“The related pressures of raised interest rates, increased project costs, and project finance continue to weigh down on new commissions,” he said.

“The housing sector is significantly under-performing but has seen a slight improvement in outlook. With inflation falling, and early signs of interest rates stabilising, there may be further improvement in the coming months.”

Malleson said practices had described a challenging market with fewer enquiries and new commissions.

“They highlight elevated project costs, protracted planning delays, and fee competition from both within and outside the profession,” he said.

However he stressed that he picture was not uniform.

“Some practices report early signs of an improving market, with more enquiries, and more opportunities for commissions from overseas,” he added.

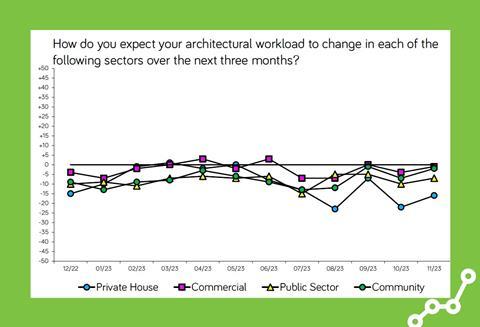

All four of the work sectors the Future Trends survey monitors are negative in terms of expectations for workload.

Nevertheless the private-housing sector, the commercial sector, the public sector, and the community sector all saw their outlook improve in November’s survey results, compared with the month before.

For the second month running, firms reported workloads down by roughly 10% on the level 12 months ago.

1 Readers' comment