Canadian family investor takes ‘significant’ interest in practice founded by Norman Foster in 1967

Foster & Partners has been bought by a Canadian private investor for an undisclosed sum.

Britain’s biggest architect, with 1,500 staff in 13 studios, announced that a “significant” stake had been acquired by Hennick Company.

The Toronto-based family firm will have the biggest shareholding, with Norman Foster and his family the next biggest stake.

Building Design understands that Foster and his office together will retain a controlling interest, but that HennickCo is the biggest single shareholder.

All parties refused to disclose the size of their stakes.

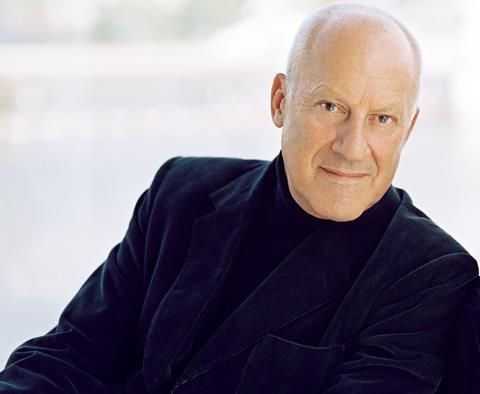

Foster, who will continue to serve as executive chairman, and his late wife Wendy founded the practice in 1967. It has been responsible for some of the world’s best-known projects, from the Great Court at the British Museum and Canary Wharf Tube station to the Reichstag in Berlin and the HSBC building in Hong Kong.

In a statement the practice said: “For Foster & Partners, this new partnership is an important step in the evolution of the practice and will encourage further growth and innovation while maintaining its distinctive culture. The long-term agreement establishes a ‘perpetual partnership model’ that enables the practice to expand beyond its current 180 partners, ensures that the next generation of professionals can become shareholders in the practice, and allows for an orderly succession of existing partners over the long-term. “

It said that at a general meeting of the shareholders, 100% of the partners voted to support what it called a strategic partnership with HennickCo.

There are currently 180 partners, who are automatically shareholders. The influx of money will allow for more staff to be promoted to partner. To mark the announcement, 24 partners were promoted to senior partner.

The firm said all present partners will remain in their current roles and the existing leadership team will retain responsibility for day-to-day operations.

In its latest report and accounts published last year, the practice said turnover in the year to April 2020 was up 5% to £272m with pre-tax profit falling from £21.5m to £11.9m. The accounts also showed the then 154 partners at Fosters shared a bumper bonus payment of more than £31m during the period.

Norman Foster said of the deal: “Towards the end of last year, we started to explore long-term structures for the practice that would respond to the challenges and opportunities of growth and encourage the next generation of leadership and this partnership is the culmination of that process. We are delighted to be joining forces with the family trust of the Hennick’s, who share our values and the pursuit of excellence. This evolution has the potential to expand the range and depth of our studio – particularly in the fields of sustainability, infrastructure, urbanisation and recycling.”

Matthew Streets, Fosters’ managing partner, said: “Our new partnership further fortifies the strong foundation on which our practice was built. HennickCo’s long-term investment horizon and partnership philosophy were important factors in our decision to align with them. On behalf of all the professionals and partners of Foster & Partners, we could not be more excited about the future.”

In a statement Bradley Hennick, managing director of HennickCo, said they were proud to partner with an “iconic global brand”.

He added: “This new partnership presents a unique opportunity to leverage our experience and long-term perspective to strengthen Foster & Partners’ position as the world’s preeminent architecture, infrastructure, engineering, and design consultancy. We look forward to working with the practice’s exceptional leadership team and partner shareholders to harness the extraordinary skills within the practice to grow into new and exciting areas in the years to come.”

Postscript

An early version of this story wrongly described HennickCo as a private equity firm. This has now been corrected.

No comments yet