Alex Shall highlights the context of this recession, and what you might learn from that to protect your practice.

Every recession is unique because the causes, the health of different parts of the economy, government interventions, the labour market and the wider circumstances are different each time. Economists might take comfort from the lessons of history but business owners need to think on their feet.

Learning the lessons of history

As a professional I am not interested in the lessons of history, and my historian wife agrees with me! I don’t live in the 1930s or the 1970s or even 2008. Interpreting the causes and responses to the Great Depression has academic value, both for historians and economists, but will not help Boris Johnson with his “new deal”. Having said that, understanding the recent historical context to this recession might help us predict what the best ways to protect our businesses will be.

Not a V-shaped recession

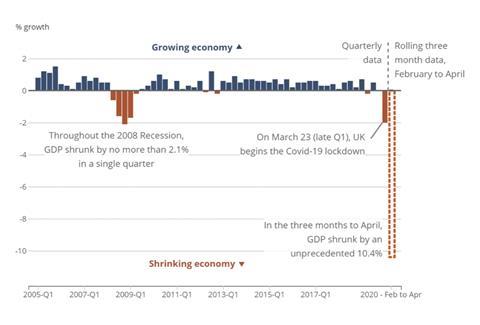

In March as lockdown commenced, everyone was talking about a V-shaped recession. The idea was that economic output would plunge as projects were placed on hold, staff furloughed and shops closed. Then lockdown would be released and we would all go back to work.

As you can see from the above graph, the plunge has happened but it is five times deeper in the first quarter than was the Great Recession of 2008. And that is in the context of the global covid-19 infection peak not being reached yet, the US situation getting worse and businesses having not yet reacted.

In every service sector recession it is the reaction of businesses to reduce customer-side demand that helps create a feedback spiral as staff are let go, costs slashed and investments cancelled. The chancellor wanted to bounce businesses out of the recession to avoid that spiral but it is evident now that it has started.

The lesson here is that waiting to see if things return to “normal” is no longer a credible strategy. Businesses across many service types are going to have to bank on a protracted and substantial reduction in demand.

Things were just getting better?

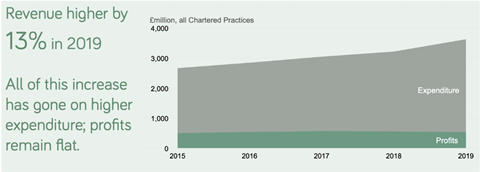

The recent story for most professional practices prior to this recession had been improving. Output for architecture and engineering consultants was growing at around 1% per year and over the decade from 2008 to 2018 had grown by more than 13%.

Of course whether you felt this yourself depended as much on your own practice’s situation as on the wider economy. For many years now there has been a widening of the performance of practices between those that are profitable and those that are struggling. Competition in architecture in particular has resulted in very tight margins. After the 2008 recession many practices let junior staff go, leaving themselves top-heavy, and were encumbered by high premises costs. Practice owners have also faced reduced retirement income and so some have reacted by deferring retirement.

Structural issues in professional practices were already a major concern before the covid-19 crisis. Recent economic growth may have eased this temporarily, but the downturn will quickly bring issues to a head for some.

Not investing in productivity

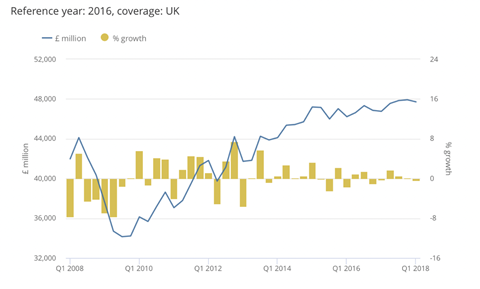

Another well commented-on trend of the last decade has been chronic under-investment by business. Investment is the motor of economic growth. It is what allows businesses to sell more services or deliver more goods and it is the catalyst for productivity improvement. But UK businesses cancelled many planned investments in the wake of the credit crunch and have feared recommitment since.

As can be seen, after the credit crunch, businesses took until 2014 to reach pre-recession levels of investment. Investment steadily grew then until Brexit caused it to stall again. Uncertainty has since stalled any further growth until the covid-19 crisis is expected to have caused a sharp fall.

Within professional practices, for example, uptake of cloud-based practice management software has been low. As a result businesses have missed the chance to take advantage of cheap AI, workflow automation or easy linkages between systems and data sources.

Outside of the cloud, business intelligence and graphical analysis software has opened up a huge range of ways to quickly summarise data – allowing practice owners to take the guesswork out of analysing past performance.

Of course the implementation of new systems requires money, management time and a willingness to explore new working practices. The reluctance of businesses to invest for the last decade undoubtedly has left many practices on the back foot now.

A final thought

As this recession starts to bite it is inevitable that practices that entered 2020 with underlying problems will be hardest hit. Some will fail, others will need to make radical changes – changes that require courage and commitment.

How we can help

With over 40 years’ experience advising architects and their practices, we are here to help in these most challenging times. For help with forecasting, tax planning, and rebuilding after covid, please get in touch.

Postscript

Alex Shall is a partner at Haines Watt

No comments yet